Global Risk Exchange (or "GRE") is a blockchain based, decentralized and open global risk exchange market, with the purpose of helping individuals, companies and organizations to access and trade and manage their risks. GRE completely reconstructed traditional risk management tools(insurance and derivative contracts) in a decentralized way, and will become the underlying operation system to support insurance and derivative transactions in the era of blockchain. GRE aims to build the infrastructure and trading platform for risk management industry in the blockchain driven world in the near future, by providing a fundamental protocol for the creation of risk events, pricing, trading, information collection and oracles to verdict specific risks. It will enable individuals and institutions around the globe to achieve risk and return equilibrium.

First of all, GRE democratize the creation of risk management tools using blockchain based smart contract and orcales, enabling any individuals and institutions who has risk management needs to create, trade and shift risks to others who are willing to take on those risks on the blockchain. It’s a platform where risk management policies and transactions are driven by real demands, where individualized and fragmented risk coverages are made possible, and insurance protections are made agile.

Secondly, GRE leverages a blockchain based decentralized exchange to help participants in the risk management contract: insured(who pay for premium and sell risks), insurer(who receive premium and take on other people's risks) and contract designer(who measures individual risks and design the contract), transact and profit from their own information and understanding of risks. The market price of the risk contract represents the market consensus and the wisdom of the crowd, which is the best measurement of the risk at the moment.

Thirdly, GRE enables a much larger base of insurance capacity providers other than traditional insurance companies and reinsurance companies, which are centralized, tightly regulated and capital intensive. Those new capacity providers can bring more liquidity and information to GRE platform and can profit from GRE by taking on various kinds of risks they understand, while making the whole risk exchange market more efficient and liquid by bringing down the entry barrier for both insured and insurer, maximizing liquidity and information flow.

GRE aims to build the blockchain infrastucture and trading platform for risk management industry in the blockchain driven world, by providing a public chian, a fundamental protocol for the creation of risk events, pricing, trading, information collection and verdict. It will enable individuals and institutions around the globe to achieve risk and return equilibrium.

WHO NEED US ?

- The InsuredThis group of users are the individuals and corporations in the real world who want to buy risk management contract(provide premiums) to hedge their risks

- Contract DesignerProvide professional risk management expertise for GRE community and can publish risk management contracts after community review and earn fees based on transaction fees collected from trading this contract.

- InsurerThis group of users are usually insurance and re-insurance companies and insurance-linked securities investors. They earn premiums from the risk management contract and take the risk transferred to them.

USE CASE

- Product Customization On DemandSteve is a supplier to Hyperloop One. He is concerned if Hyperloop One would succeed in the first test drive. He tries to insure for Hyperloop One but few insurance companies would take his request. Steve learned about GRE platform. He submitted request and soon the product is made possible so he placed the order.

- Open Insurance Policy DesignVictor is an actuary. On GRE Community he saw the request for a mechanical failure insurance of Hyperloop One test drive and did extensive research and made a policy. GRE platform offers a Proof of Work mechanism to reward a percentage of premium to underwriters.

- Buy CapacityMonica is a supporter of Elon Musk. She strongly believe the future of Hyperloop One. In reality, all she can do is to advocate for the company, but with GRE platform, she can be much awarded by buying capacity for mechanical failure insurance. Once Hyperloop One test drive succeeded, she would get paid premium as profits.

- Hedge from Risks in RealityJohn is heavily invested in Tesla stocks. He believes Hyperloop One test drive’s success would boost Tesla stock but he’s also looking for an insurance policy to hedge. He saw mechanical failure insurance on GRE platform, so he also bought coverage.

- Secondary MarketAfter a month, Hyperloop One announces to put off test drive indefinitely. This news affected everyone’s risk estimates. John decides to pursue another investment opportunity and liquid all his Tesla shares, and meanwhile sell his insurance policy at a discounted rate on GRE. Steve on the other hand hopes to increase coverage so he took over John’s policy.

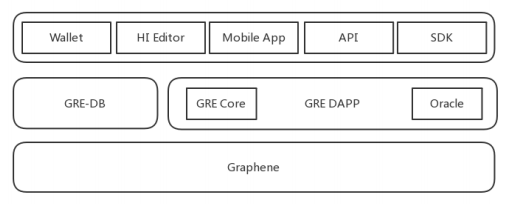

GRE System Architecture

GRE is a decentralized, open-source global risk exchange and the platform is built on Graphene blockchain library.

Core Components

- Graphene Blockchain LibraryGraphene blockchain library is a blockchain tool kit developed by Cryptonomex, the core development team of Bitshares, and is featured with high concurrency capacity and quick block confirmation time compared to Bitcoin and Ethereum. The Graphene tool kit is widely used among trading applications on blockchain. GRE will use Graphene as the underlying blockchain component, using the DPoS consensus mechanism to ensure the efficiency and stability in GRE systems and community.

- GRE CoreGRE Core is a set of data, storage, presentation, matchmaking mechanisms, claimsmethods, and related codes for risk, insurance, and financial derivatives. GRE Core willimplement the generation, preservation, transaction, claims and other functionalities forGRE platform. . It is the very foundation of GRE ecosystem.

- GRE Application and WebsiteGRE will provide a user interface compatible with mobile and web environments.

- Oracle for Hazard Identification

- Distributed Database

Our distributed database will store private information of users, including personal ID, data needed to price individualized risks and other sensitive information. The realization of distributed database could refer to Steem (An incentivized, blockchain-based, public content platform).- API and SDK

Based on blockchain technology and distributed database, GRE will provide blockchain based smart contract and token economics to match and clear risk management contracts with API and SDK, which would help all participants in GRE ecosystem to easily integrate GRE into their current system.- High Performance

Built on Graphene tool kit, GRE could reach an average of 1.5 second block confirmation time and 100,000 transactions per second(TPS). It is comparable to the transaction processing speed of a traditional centralized network.- All-platform

Supporting not only PC and mobile, but also API and SDK to meet the needs of different types of users.- High Efficiency

GRE improved the efficiency of all parts in traditional insurance value chain through Oracle and API and reduced the intermediary cost at the same time.- Individualized

Based on the community-managed, continued expanding database of RDHI, users can customize risk contracts to suit their individual needs, and also trade risks in derivatives market, which will further increase their risk management capability.- Long-term Dvelopment Plan

After finish developing the risk management contract trading functions, GRE will focus on the development of derivatives market, providing users with functions such as realworld policy pledge, secondary contract trading and so on.- Decentralized Zero Threshold

- Primary and Secondary Financial Markets Enable Risk Pricing

- Smart Contract, Replace Traditional Institutions

- Distributed Database Protect User Privacy

- All risk management contract transactions on the GRE platform use RISK token as transaction intermediary, and the settlement of the contracts will use RISK as well.

- Users in GRE platform will pay transaction fees using RISK token.

- Any organization or individual can create a risk management contract on GRE platform after comunity review and obtain a transation volume based rewards.

- The community will reward developers with RISK token based on their code contribution.

- All individuals and organizations are able to share contracts on GRE platform and attract new customers to trade risk mangement contracts and they will receive a reward from transaction fee collected from the new customers they invite.

- Exchange dealers on GRE platform can RISK as collateral to issue market pegged tokens, such as GRE.USD or GRE.CNY. This mechanism is similar to the BTS and BITUSD in the Bitshares ecosyetem.

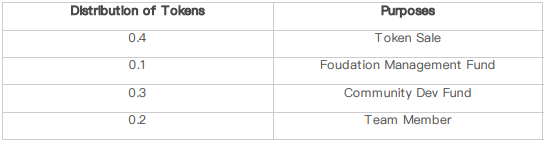

- 10% for Foundation managed fund, used for GRE Foundation's operation, will release in the next 2 years;

- 30% for community development fund, used for reward partners who contribute to GRE community.

- 20% for founding team and development teams, those tokens will be assigned to founding teams, such as early community contributors and future team members. As a team incentive plan, those tokens will be released step by step in two years, and unlocked 25% in every six months.

- GRE-Core development

- Centralized Oracle development

- Demo of GRE App development

- Demo version of App-server development

- HI editor development

- Mobile wallet development

- Official App development

- Continue GRE-Core and Oracle development

- Development of Alpha Edition

- Provide API & SDK

- Security audit

- GRE test running

- Basic RDHI library content production

- KYC related development

- Security audit

- Complete migration to public chain

- Formal operation of the GRE primary market

- Development of secondary market editor

- Content production of secondary market base

- Secondary market security audit

- Complete development of the Alpha version of secondary market

Firstly, we will construct a centralized oracle for data source, which inherently integrate data APIs for major risk events (crypto prices, weather, commodity price, index and etc.). Users can also assign data source(URL) and parse rules (JSON/XML/HTML) while creating risk events, which will automatically crawl and parse data source and incorporate its results into blockchain. Besides, Oracle can also provide certification for authenticity (Prove the result generated by accessing web page is authentic instead of made-ups via TLSNotary. Technical details can be found at: https://tlsnotary.org/TLSNotary.pdf). Finally, after Oracle comes up with a conclusion, sufficient time is provided for users to raise any objections, and human intervention will be needed if necessary.

The second step is to build a Oracle based on voting results which rewards the data source giving correct answers and build a dispute settlement mechanism using DPoS.

Features of GRE

MAIN BENEFITS

TOKEN CONCEPT

Token Sale Plan

GRE will issue 40% of all tokens to community members.

The rest of RISK's distribution plan:

Chinese citizens will not be allowed to participate in RISK token sale plan. Any Amercian citizen, permanent resident, or green card holder will not be allowed to involved in RISK's token sale plan, unless someone is a qualified investor after being certified in accordance with relevant U.S. securities laws.

Roadmap

2018 Q1

2018 Q2

2018 Q3

2018 Q4

2019 Q1

FOR MORE INFORMATION PLEASE VISIT:

Komentar

Posting Komentar